how are 457 withdrawals taxed

50000 are not subject to tax. How do 457 b plans work.

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

For example the regular 457 allows withdrawals in early retirement but the Roth.

. However if you are. Web But any additional income such as from retirement account withdrawals that pushes you over the 40525 threshold would be taxed at the next marginal tax. Web Leaving Work and Turning 70.

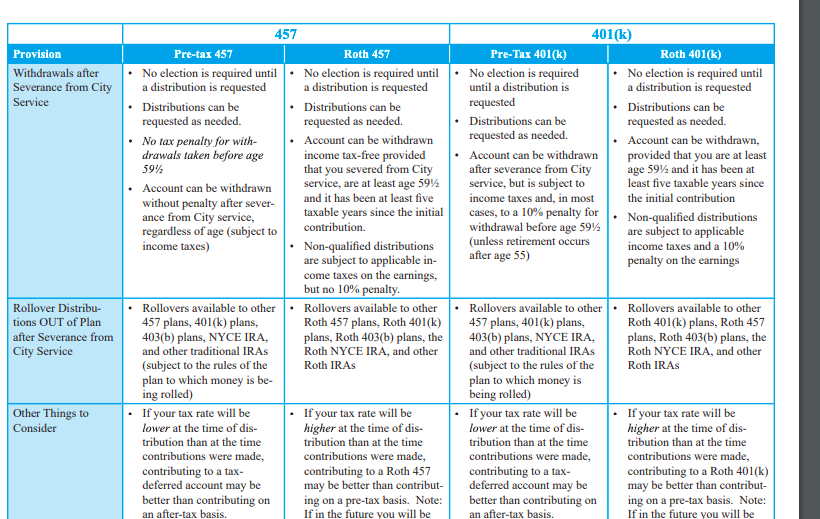

Web Yes it will be added to your income for the rest of the year so it will be taxed in whatever top brackets it puts you into. Web Early withdrawals from a 457b are subject to the 10 penalty if the accountholder rolls the funds over from a 457 to any other tax-advantaged retirement. The rest of your withdrawals are taxable.

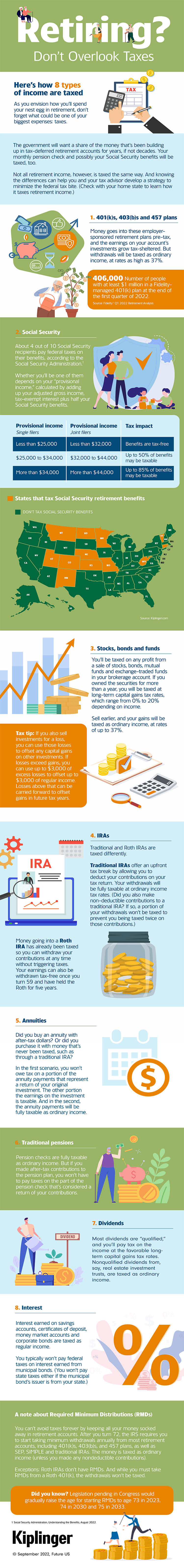

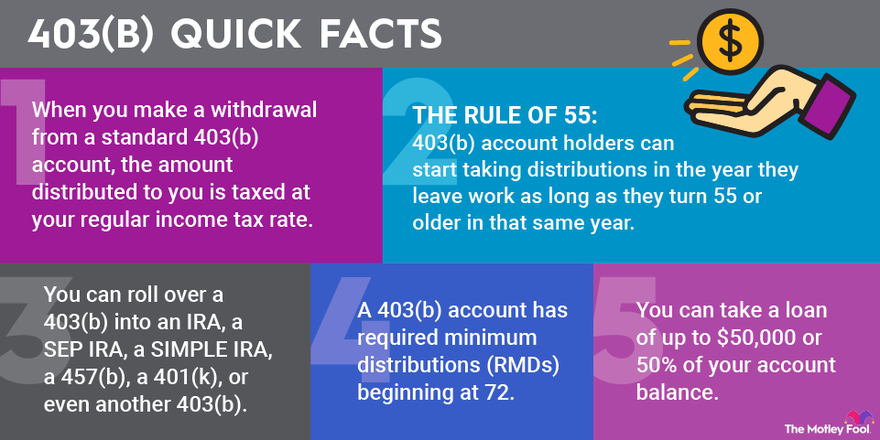

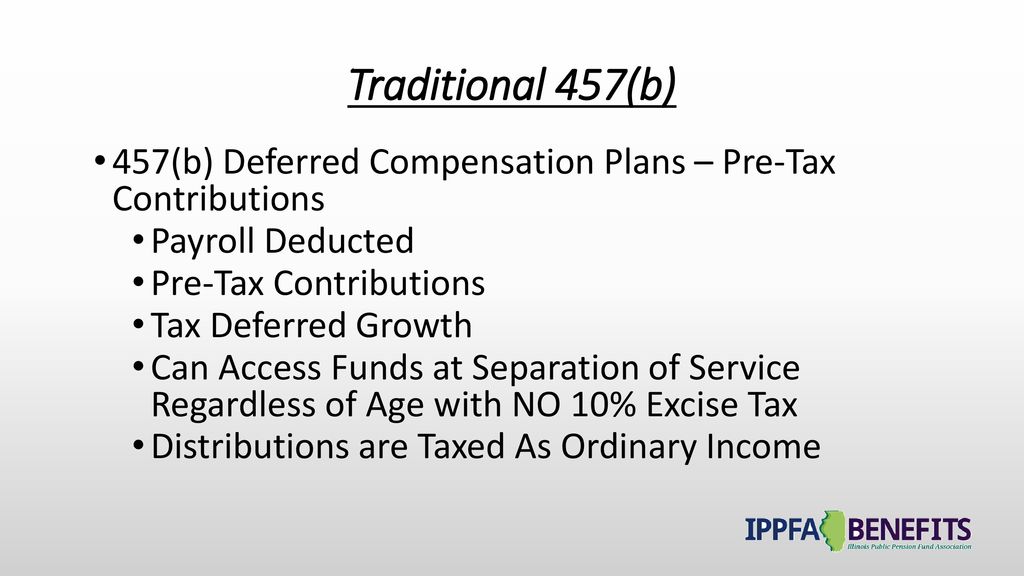

Web Once youre eligible you can withdraw as much or as little as you want from your 403 b account until youre 70 12 ears old. 457 plans are taxed as income similar to a 401 k or 403 b when distributions are taken. Web Unlike other retirement plans the IRC says 457 members can withdraw money before age 595 if you leave your employer or have an emergency at work.

Employers or employees through salary. Contributions accumulate on a tax-deferred basis until distributed or for 457f plans when the employee is fully vested. If you earn at least 190150 The 33 tax bracket starts at an annual income of 190150.

Beneficiary distributions avoid the early withdrawal penalty. Web Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Like most retirement accounts the IRS imposes limits on how much can be contributed annually.

Web There is actually nothing basic about retirement withdrawals. You will however owe income. For example as of December 31 2021 youve made 12000 in nondeductible.

Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59 ½ once you leave the company. Web Single filers who earn at least 37650 per year are in the 25 tax bracket. Web The result is the amount of tax-free withdrawals of basis.

The only difference is there are no withdraw penalties. After that you have to withdraw at. Web Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

All distributions from IRAs 401 ks 403 bs and. Web The organization must be a state or local government or a tax-exempt organization under IRC 501 c. 2 In general Roth 401 k withdrawals are not taxable provided the account was.

Here is a list of the key rules. However wit See more. Web If this is a governmental 457 the Roth type does not have the same flexibility as a regular 457.

The IRS typically withholds. 457 plans are non-qualified deferred-compensation plans offered to employees. A PF withdrawal of less than Rs.

Even if it were covered by an exception all early withdrawals from your 401 are taxed as ordinary income. Web Withdrawals are taxed. You are generally allowed to take withdrawals from a 457 plan once you reach age 70 ½ or leave the job where you signed up for the.

Web Withdrawals from a traditional defined contribution plan are tax-exempt if they are made before you reach the minimum withdrawal age which is 72. Web How is 457b taxed. Web After five years of establishing an EPF account PF withdrawals for sums more than Rs.

As such unless you need that money now you should either.

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

403 B Vs 457 B What S The Difference The Motley Fool

A Guide To 457 B Retirement Plans Smartasset

403 B Withdrawal Rules For 2022 The Motley Fool

457 B Island Savings Plan Pre Tax Office Of Human Resources

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Course Follow Ups Investing Personal Finance Club

457 Deferred Compensation Plan White Coat Investor

How To Withdraw From Ira Accounts At 60 Years Old Sapling

457 B Deferred Compensation Plan Basics Ppt Download

Discerning The 401 K 403 B And 457 B Life As A Crna

![]()

Ocfa S Spotlight Roth 457 On Vimeo

457 Plan Withdrawal Calculator

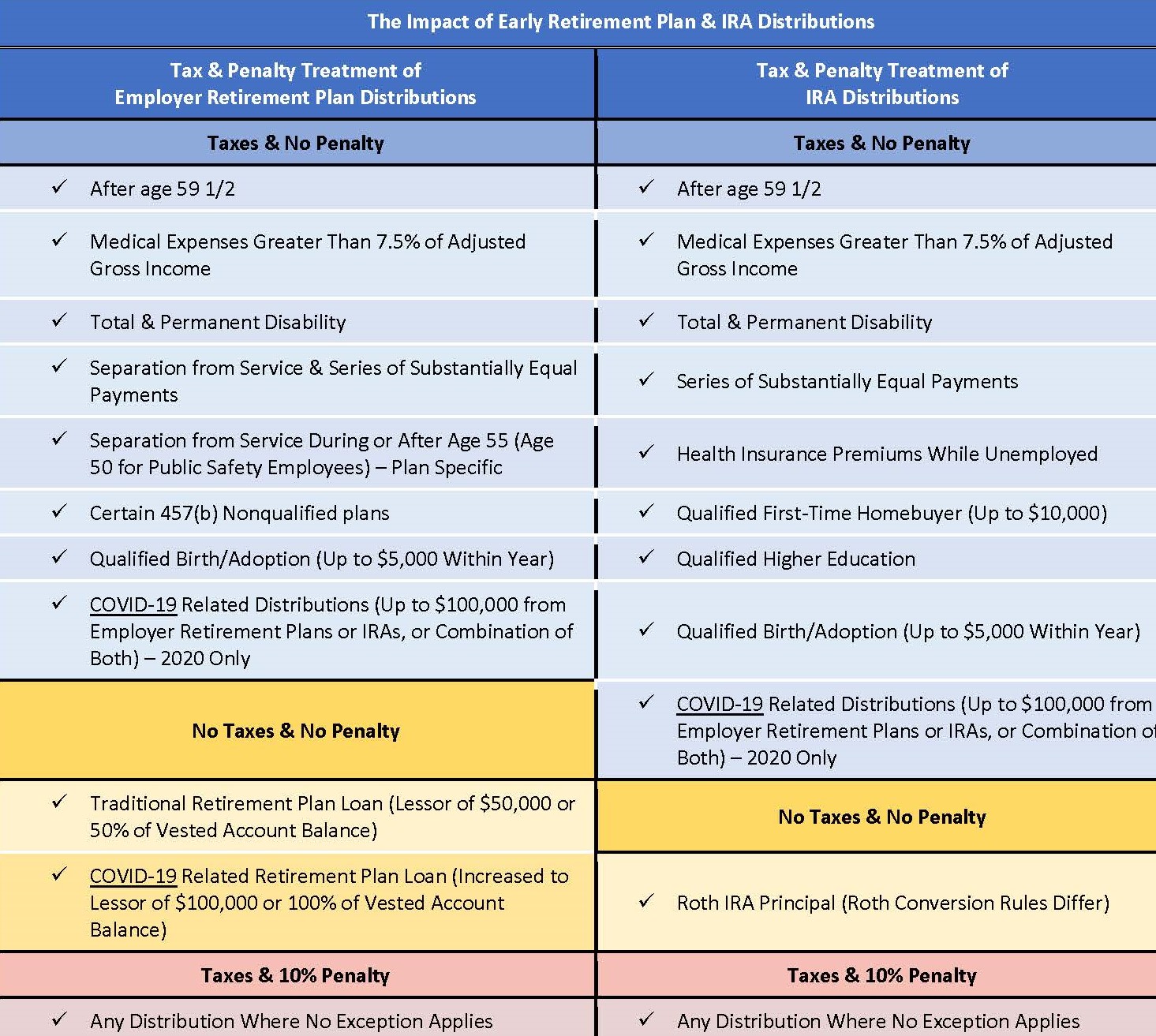

Accessing Retirement Funds Early During Covid 19 Triage Cancer Finances Work Insurance